Experts Who Help You Improve Your Business

Successes

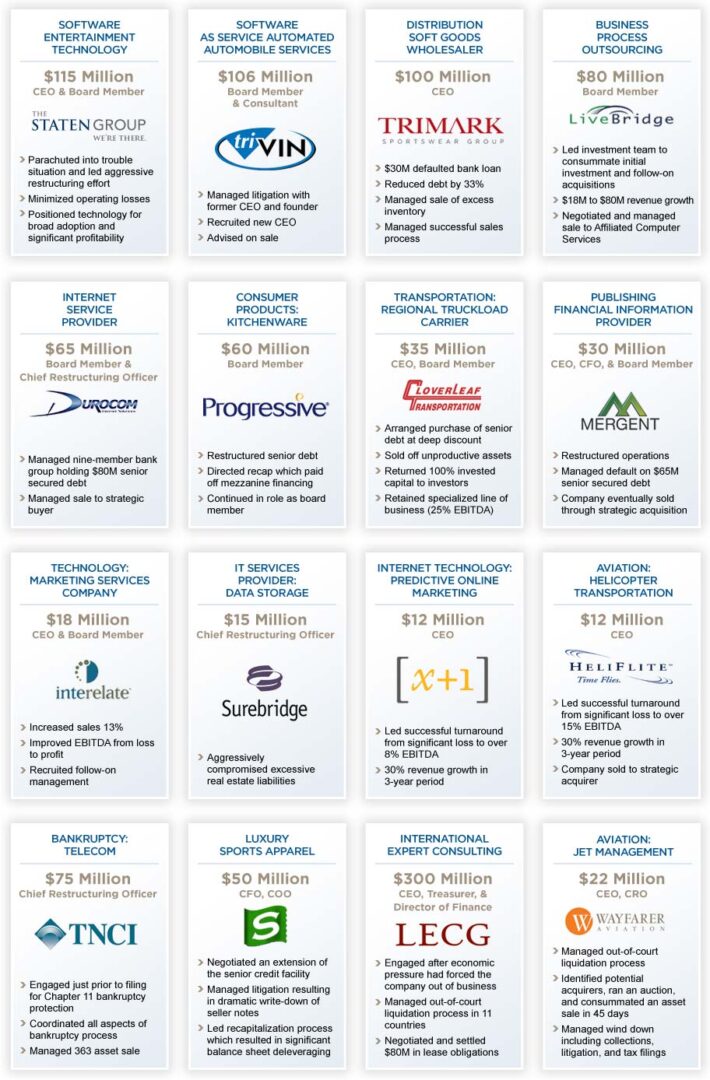

Case Studies

After a very successful financial turnaround, HeliFlite, the Northeast's premier provider of luxury helicopter service, begins a transition from The Staten Group's leadership to full time, long-term management.

VVhile HeliFlite has always maintained operational excellence, The Staten Group was engaged in 2006 after the Company reported a significant financial loss. Under the Staten Group's direction, the Company attained industry leading EBITDA rnargins.

In July of 2010, The Staten Group sourced the equity capital for a change of control transaction which deleveraged the balance sheet and provided growth capital. 2011 marked 44% growth in charter sales, the rnost profitable business segment.

The Staten Group team was led by Bruce Rogoff as CEO, Brian Lantier as Director of Strategy and Business Development, and Bill Huntington as Director of Finance. Despite The Staten Group's aggressive cost cutting, HeliFlite maintains a pristine reputation for safety and exceptional customer service as recognized by industry leading audit firms.

In 2012, The Staten Group turned over operational control of the business to a new CEO and remains on as consultants and minority equityholders.

The Staten Group announces a successful recapitalization of Summit Golf Brands. Summit Golf Brands is a leader in the luxury golf apparel industry with a portfolio consisting of three brands: Fairway & Greene, EP Pro and Zero Restriction.

The Staten Group was engaged in 2010 when the Company was in covenant default with its bank and payment default on seller notes. The Staten Group, led by Bruce Rogoff, spearheaded a successful negotiation of an extension of the senior credit facility. In 2011 Bruce Rogoff and Brian Lantier stepped in to serve as interim CFO and COO and supported the Company's executive search.

The Staten Group continued to manage the litigation process that resulted in a dramatic write-down of seller notes. Further, they managed a recapitalization, which resulted in significant balance sheet deleveraging and an increase in working capital.

The Staten Group continues to provide advisory services to the Board and the senior management team.

The Staten Group announces a successful turnaround of Security Source.

Security Source is a nationwide provider of lock and hardware and video surveillance products and services. The Company offers multi-location organizations 24/7 support across the US, Canada and Puerto Rico.

Security Source was purchased by The Staten Group in 2005 from Technology Crossover Ventures and Ascent Venture Partners. At the time, the business was suffering from very low profit margins and a highly encumbered balance sheet. The Staten Group took over as Chairman, CEO and CFO and was successful in negotiating a significant reduction in liabilities, and increasing free cash flow sufficient to pay off the senior lender.

The Cornpany has doubled revenue over a five-year period while increasing profitability from a loss to over 14% EBITDA margins with no debt. In 2018, Security Source sold its Lock and Hardware Division to focus exclusively on electronic security integration.

In addition to significant organic growth, the Company purchased Martco in 2013 and is looking for additional acquisition opportunities.

SECURITY SOURCE

Services

We specialize in leadership, financial and board-level advisory services to under performing companies. We are solely focused on supporting equity holders and junior security holders.

Whether it's a need for strong industry expertise, extensive C-level operating experience, multiparty negotiating skills, complex accounting and legal capabilities or sophisticated financial and tax structuring, we bring to each situation analytical rigor and a contagious energy that drives success.

In everything, we offer specialized, company-specific strategies with a focus on execution, accountability and results.